No Credit Check Loans South Africa: A Fast Financial Lifeline Without the Red Tape. When facing urgent expenses or unexpected financial difficulties, many South Africans find themselves needing quick access to cash. However, if you have a poor credit history or no credit score at all, traditional banks might not be an option. That’s where no credit check loans in South Africa come into play. These loans are designed to provide fast financial relief without the lengthy and often frustrating credit approval process.

🔍 What Are No Credit Check Loans in South Africa?

No credit check loans are financial products offered by certain lenders that do not require a credit history review through credit bureaus like TransUnion, Experian, or Compuscan. Instead of your credit score, the lender typically evaluates your current income, employment status, and ability to repay the loan.

These loans are popular among people who:

- Have a poor credit score or previous defaults

- Have no credit history

- Need fast approval and disbursement

- Want to avoid affecting their credit profile with a hard inquiry

With these options, many South Africans can get the help they need — even within 24 hours.

💼 Personal Loans in South Africa: Amounts, Interest Rates, and Terms

Personal loans are one of the most commonly used financial products in South Africa, available through both traditional banks and online lenders. They can be used for various purposes — from consolidating debt to covering education fees, medical costs, or unexpected emergencies.

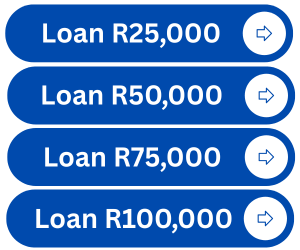

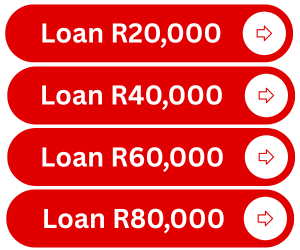

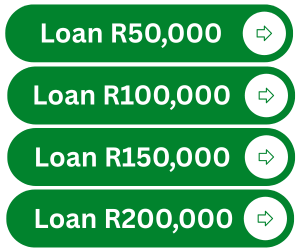

💰 Loan Amounts

The loan amounts typically range depending on the lender and the borrower’s credit profile:

- Minimum: R1,000

- Maximum: R300,000 (some banks offer up to R350,000)

- Microloans (like payday loans): R500 – R8,000

📊 APRs (Annual Percentage Rates)

The APR includes the interest rate and any fees associated with the loan. In South Africa, the National Credit Act (NCA) sets limits on maximum interest rates based on the repo rate (currently 8.25% as of 2025).

As of recent updates:

- Personal loans APR range: 12% – 27.75% per annum

- Short-term microloans: May have monthly rates of 5% (up to 60% APR or more annually, effectively)

⚠️ Always review the total cost of credit (TCC) — it includes initiation fees, monthly service fees (max R69), and VAT.

📆 Loan Terms

- Short-Term Loans: 1 to 6 months (common for payday or no credit check loans)

- Standard Personal Loans: 6 months to 72 months (6 years)

- Flexible Repayments: Many lenders offer early repayment options with no penalties

🏦 Typical Bank Offers (As of 2025)

| Bank/Lender | Loan Amount | Term Length | APR (Typical) |

|---|---|---|---|

| Capitec Bank | R5,000 – R250,000 | 1 – 84 months | 13.25% – 27.50% |

| FNB | R1,000 – R300,000 | 1 – 60 months | Variable, based on credit |

| Nedbank | R2,000 – R300,000 | 6 – 72 months | 10.5% – 24.5% |

| Standard Bank | R3,000 – R300,000 | 12 – 72 months | 12.75% – 27.75% |

| African Bank | R2,000 – R250,000 | 7 – 72 months | Fixed-rate offers available |

| Finchoice | R100 – R40,000 | 1 – 24 months | Short-term rates |

📱 Online No Credit Check Loans: Apply Anytime, Anywhere

Thanks to digitization, online no credit check loans have become widely available. You can complete the entire process — application, approval, and fund transfer — without leaving your home.

Benefits of Online No Credit Check Loans:

- Fast processing: Many lenders offer same-day decisions

- No paperwork: Entirely digital application process

- Minimal documentation: Usually only ID, proof of income, and bank statement

- No hard inquiries: Won’t damage your credit score

Popular online platforms for these loans in South Africa include short-term lenders, payday loan providers, and fintech-driven microloan companies.

🚫 Bad Credit Loans No Credit Check: Financial Support Despite Defaults

Many South Africans struggle with bad credit due to late payments, defaults, or past judgments. However, bad credit loans no credit check offer a second chance. These loans are tailored for individuals with low creditworthiness but reliable income sources.

Who Can Qualify?

- People with judgments or defaults

- Those previously declined by banks

- Individuals under debt review (in some cases)

- Unemployed but receiving a steady income (e.g., SASSA grants)

Some lenders even offer unsecured loans with flexible terms and fixed monthly repayments.

💸 Payday Loans No Credit Check: Short-Term Cash Until Your Next Salary

Payday loans no credit check are ultra-short-term loans, usually repaid on your next payday. While they offer instant cash relief, they often come with higher interest rates and stricter repayment terms.

Key Features:

- Loan Amount: Usually R500 – R5,000

- Repayment Term: 1–30 days

- Best For: Emergency expenses or cash flow gaps

- Requirements: Proof of regular income, valid ID, South African bank account

⚠️ Caution: Payday loans can be expensive if not managed responsibly. Always read the terms and conditions before agreeing to any loan.

🛡️ Are No Credit Check Loans Safe?

Yes — as long as you choose registered credit providers in South Africa. Look for lenders that are registered with the National Credit Regulator (NCR). You can verify this on their website (www.ncr.org.za).

Red flags to avoid:

- Upfront fees before approval

- No physical or digital contact information

- No registration number or unclear terms

Always review the loan agreement, interest rate (APR), fees, and repayment plan before signing.

🤔 Frequently Asked Questions (FAQs)

1. Can I get a loan with no credit check if I’m blacklisted?

Yes, some lenders specialize in offering bad credit or blacklisted loans. However, expect higher fees and limited loan amounts.

2. Will applying affect my credit score?

No — if it’s a true no credit check loan, your score won’t be affected during the application process.

3. Can unemployed individuals apply?

Some lenders accept applicants receiving unemployment income, grants, or pensions, but this varies by provider.

4. How quickly can I receive the funds?

Some lenders offer same-day payouts — especially for immediate loans no credit check.

📌 Final Thoughts: Are No Credit Check Loans Right for You?

No credit check loans in South Africa can be a lifeline when you’re in a bind. They offer fast, convenient, and accessible solutions for people who might otherwise be excluded from the traditional financial system.

However, always:

- Borrow only what you can afford to repay

- Use registered lenders

- Understand all the fees and interest rates

By doing so, you can take advantage of these financial tools responsibly and safely.